Unlock Your Possible with Professional Loan Services

Discover Reliable Financing Solutions for All Your Financial Requirements

In navigating the large landscape of financial services, discovering trusted loan carriers that accommodate your specific demands can be a difficult task. Whether you are thinking about personal financings, online lending institutions, lending institution, peer-to-peer lending platforms, or government help programs, the options seem endless. Among this sea of choices, the essential question stays - how do you recognize the trustworthy and reputable methods from the rest? Let's discover some key factors to consider when choosing loan services that are not only reliable however also customized to fulfill your special monetary needs - Financial Assistant.

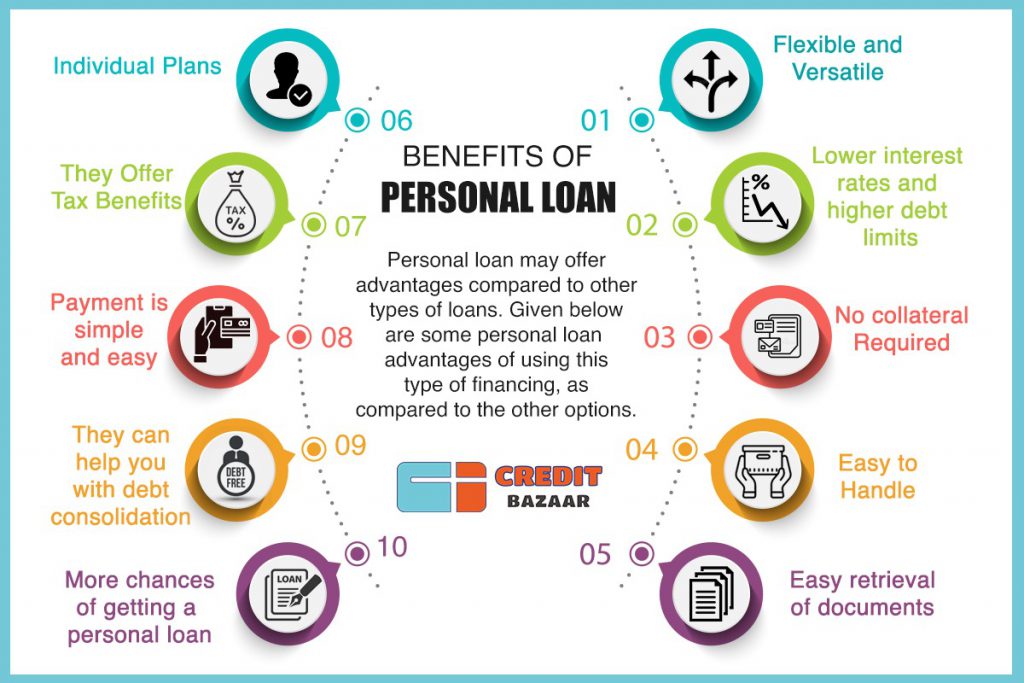

Kinds of Individual Financings

When taking into consideration individual finances, people can choose from different types customized to fulfill their certain financial requirements. For people looking to consolidate high-interest financial debts, a financial debt consolidation financing is a practical alternative. Furthermore, people in requirement of funds for home restorations or significant purchases may opt for a home renovation car loan.

Benefits of Online Lenders

Comprehending Lending Institution Options

Credit scores unions are not-for-profit economic cooperatives that use a range of items and solutions similar to those of banks, consisting of savings and checking accounts, fundings, debt cards, and extra. This ownership framework frequently equates right into lower costs, competitive rate of interest prices on lendings and savings accounts, and a strong focus on client service.

Credit unions can be interesting individuals seeking a much more individualized approach to banking, as they generally focus on member satisfaction over earnings. Additionally, debt unions usually have a strong neighborhood visibility and may provide financial education and learning resources to assist click resources members improve their monetary literacy. By recognizing the choices available at credit score unions, people can make educated choices about where to leave their financial requirements.

Discovering Peer-to-Peer Loaning

One of the essential attractions of peer-to-peer financing is the capacity for lower passion rates contrasted to conventional economic institutions, making it an attractive choice for debtors. Additionally, the application procedure for obtaining a peer-to-peer funding is typically structured and can result in faster accessibility to funds.

Capitalists additionally profit from peer-to-peer borrowing by potentially earning higher returns compared to conventional investment options. By removing the intermediary, investors can directly fund consumers and obtain a section of the passion settlements. Nonetheless, it is very important to note that like any type of financial investment, peer-to-peer financing lugs fundamental risks, such as the possibility of borrowers defaulting on their fundings.

Entitlement Program Programs

Among the progressing landscape of economic solutions, an important aspect to take into consideration is the world of Federal government Assistance Programs. These programs play an important duty in supplying financial help and support to people and businesses during times of requirement. From joblessness benefits to bank loan, entitlement program programs intend to ease economic concerns and promote financial stability.

One prominent instance of an entitlement program program is the Local business Management (SBA) fundings. These finances use desirable terms and low-interest prices to aid little organizations grow and browse challenges - mca funders. Additionally, programs like the Supplemental Nourishment Support Program (SNAP) and Temporary Aid for Needy Households (TANF) give important assistance for individuals and family members dealing with financial hardship

Additionally, entitlement program programs expand beyond financial assistance, incorporating real estate aid, healthcare aids, and academic gives. These efforts intend to deal with systemic inequalities, promote social well-being, and make certain that all citizens have accessibility to basic needs and chances for development. By leveraging entitlement program programs, people and companies can weather financial storms and make every effort towards a more secure monetary future.

Final Thought